When it comes to managing your finances, tools like Monarch Money have gained popularity for their ability to aggregate accounts and provide insights into your overall financial health. But what happens when you need more control over your data or granular insights into your finances? That’s where FinancialAha’s Financial Planning Templates for Google Spreadsheets shine as an alternative.

Why Look for a Monarch Money Alternative?

Monarch Money is a great tool, but users often report challenges like:

- Account syncing issues that lead to inaccurate data.

- Limited customization for specific financial scenarios.

- A lack of in-depth reporting for long-term financial planning, such as retirement or investment growth.

If these concerns sound familiar, FinancialAha’s spreadsheet template might be the perfect solution for you.

What Makes FinancialAha Spreadsheet Different?

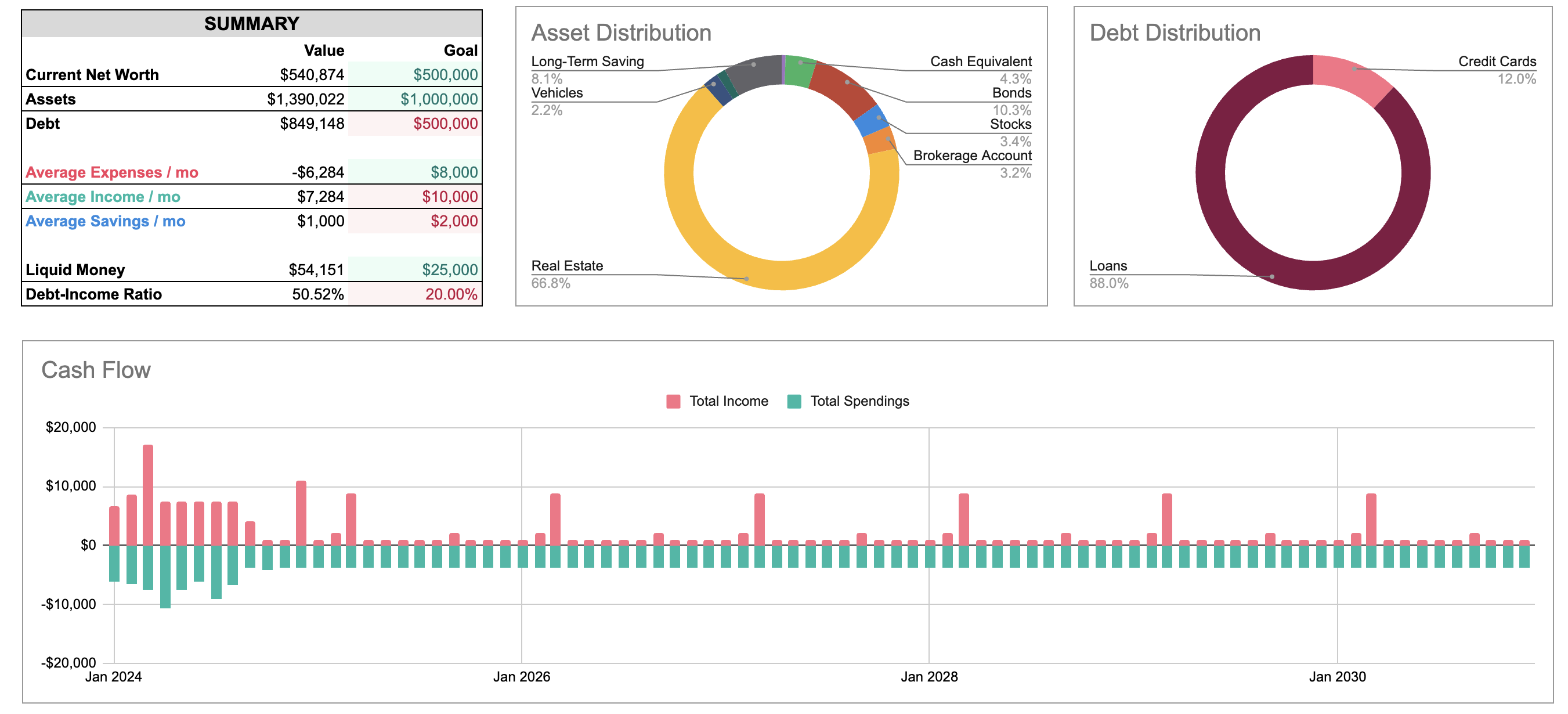

1. Full Customization for Your Financial Goals

Unlike apps that automate inputs but limit flexibility, FinancialAha’s spreadsheets allow you to manually input and customize your data. This gives you complete control over:

- Income sources (e.g., salary, investments, pensions).

- Expenses, categorized however you see fit.

- Savings and investment growth projections.

- Retirement planning scenarios with adjustable variables like inflation and investment returns.

You’re not boxed into predetermined formats or calculations—everything can be tailored to your unique financial situation.

2. Detailed Insights with No Hidden Formulas

With FinancialAha financial planning spreadsheet template, all formulas are visible, allowing you to understand exactly how your financial forecasts are calculated. For those who want deeper insights into their financial future, this transparency is invaluable.

You can model complex scenarios like:

- How inflation affects your long-term expenses.

- Strategic withdrawal rates for retirement savings.

- The impact of investing earlier vs. waiting.

3. No Syncing Issues, Ever

One of the biggest pain points with automated tools like Monarch Money is account syncing. FinancialAha’s spreadsheets eliminate this issue entirely. Since all inputs are manual, you’re always working with accurate, up-to-date numbers that you control. You won’t have to worry about syncing errors or missing data that could throw off your financial plan.

4. Affordable and Accessible

While many financial apps require ongoing subscriptions, FinancialAha offers a one-time purchase model. You gain lifetime access to the spreadsheet template—no recurring fees or worries about losing access to your data.

FinancialAha’s Google Spreadsheets template is ideal for:

- DIY financial planners: If you enjoy being hands-on with your financial data, this is the tool for you. You can customize every aspect of your financial plan to match your goals and always know how your numbers are calculated.

- Retirees: Plan your withdrawals, track your expenses, and ensure your nest egg lasts. You can project your retirement income and expenses with confidence and adjust your plan as needed.

- Investors: Model how changes in returns, contributions, or withdrawal rates impact your portfolio. Net worth tracking, investment growth projections, and asset allocation tracking are all at your fingertips.

- Anyone frustrated with automation: If syncing issues or lack of customization have left you frustrated, FinancialAha offers a refreshing alternative. With manual inputs and full control over your data, you can build a financial plan that works for you.

How to Get Started

Using the FinancialAha template is straightforward:

- Purchase the spreadsheet here .

- Open it in Google Sheets.

- Start inputting your data and tweaking it to match your unique financial picture. No steep learning curves or complex setups—just practical tools to help you plan with confidence. The template is designed to be user-friendly, with clear instructions and examples to guide you through the process.

While Monarch Money is an excellent app for many, FinancialAha’s spreadsheet template stands out for those who crave deeper customization, transparency, and control. Whether you’re planning for retirement, managing investments, or simply tracking expenses, this tool can help you take charge of your finances.

Ready to try something new? Check out FinancialAha’s template and take the first step toward a more personalized financial plan.