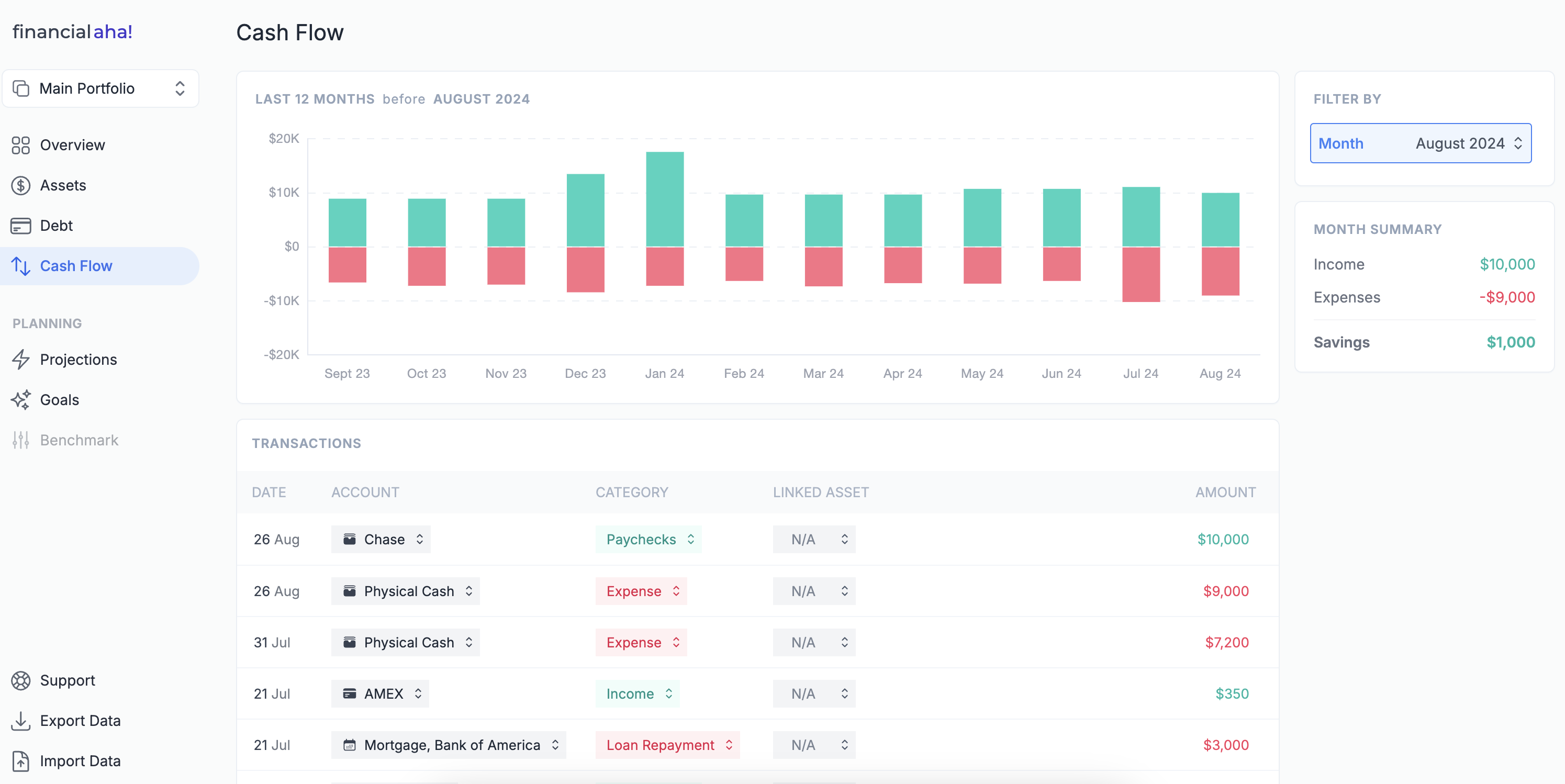

Your Cash Flow Trends

Aggregate your income and expenses into comprehensive cash flow insights to understand and make better spending and financial planning decisions.

Financial Planning Tools Start for free

Income streams

No matter how diverse your portfolio is, never overlook of your income streams and their variability.

Income sources. FinancialAha makes it easy for you to track and analyze the diversity of your income sources. For investors, this might include dividends, rental income, interest, capital gains, business profits, and possibly others.

Income stability. Achieve a great financial planning by using the right tools to understand the reliability and variability of your income streams to ensure consistent cash flow.

Expenses optimization

No matter the level of detail track, plan and analyze expenses.

Categorizing expenses. Examine detailed budgeting, condensing your expenses in various categories, including essential costs and discretionary spendings, in order to identify areas where costs can be reduced to achieve your goals.

Tracking expenses. With complete flexibility on the level of detail, you can create your own style of expenses tracking that increases your efficiency in managing cash flow and planning your finances.

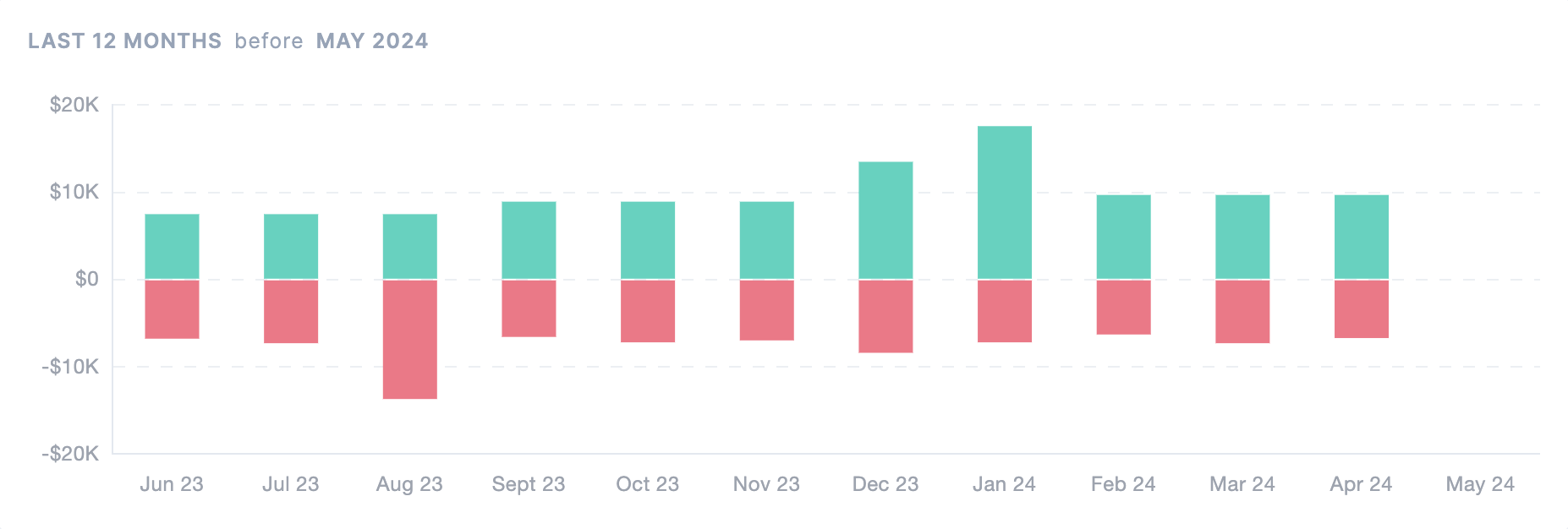

Cash flow projections

Create a financial planning strategy that always keeps your cash flow in balance.

Forecasting. Create cash flow projections based on your historical income and expenses data for different time horizons.

Emergency fund. Discover cash flow gaps in your financial planning and make sure you have emergency funds to cover for them without necessarily resorting to selling investments or incurring additional debt.

Tax planning. Plan future tax payments in your financial planning cash flow with FinancialAha's tax planning tool.

Scenarios. Easily create and analyze different financial scenarios to assess the potential impact on yoour financial planing cash flow. For example, you could evaluate the effects of a market downturn, changes in interest rates, or major life events on your financial situation.

Timing expenses. Whether it's purchasing a home, funding higher education, starting a business, or any other major financial endeavor, FinancialAha empowers you to plan your cash flow, making sure you have sufficient income at the right time.

Asset liquidity. FinancialAha lets you analyze the liquidity of your assets, making it easy for you to ensure sufficient liquidity when needed to meeting financial commitments, and seizing investment opportunities as they arise.