Financial Planning Template

for Google Spreadsheets

Start managing your finances using the financial planning template crafted by the FinancialAha team. Pay once, and enjoy lifetime access, with the flexibility to adjust it to your unique financial needs.

Why use a financial planning template?

We have been using and refining this template for several years before building the FinancialAha app. It has gone through many iterations and lots of improvements.

31+ hrs to create it yourself

- 6 hrs to setup asset tracking

- + 3 hrs to setup debt tracking

- + 8 hrs to add cashflow

- + 7 hrs add projections

- + 4 hrs to sumarize everything

- + 2 hrs to make it look beautiful

- + 1 hr to connect to Google Finance

- + ∞ hours of overthinking...

or

Use our Financial planning Template

for Google Spreadsheets

for only

$12.99 USD

pay once, own it forever

Get accessAll your Assets

in one place

Do your financial planning by knowing how your finances are spread across multiple types of assets, and update them frequently for better understanding of your wealth distribution.

Cash Account

Cash Equivalent

Bond

Stock

Brokerage Account

Real Estate

Vehicle

Digital Asset

Cryptocurrency

Equity

Collectible

Commodity

Intellectual Property

Long-Term Savings

Other Asset

Your entire Debt

under watch

Never lose sight of how much debt you are accumulating and adjust your to keep it under control.

Credit Card

Loan

Debt obligations. All your outstanding debts divided by type, including credit card balances, student loans, mortgages, auto loans, and any other forms of debt.

Progress logging. Track the progress of your debt by periodically logging the current balances of your debts.

Debt goals. Set personalized debt goals such as debt-to-income ratio and track your progress toward these goals.

Debt overview. A centralized dashboard that displays an overview of all your debts, outstanding balance, and debt distribution.

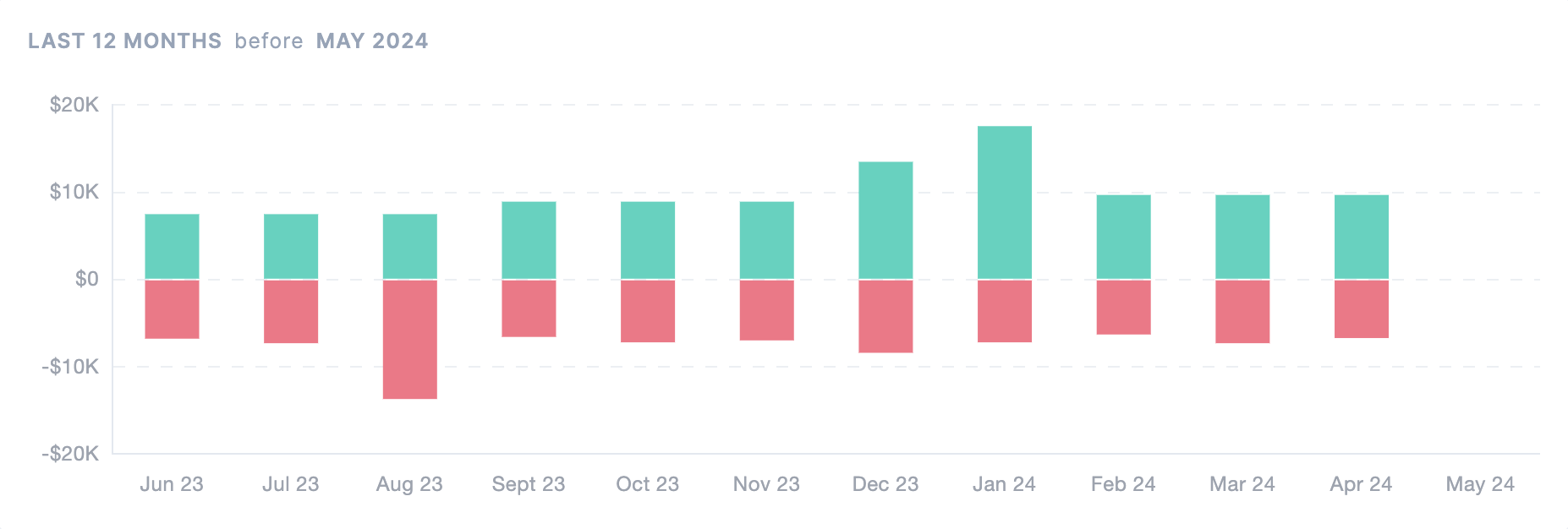

Cash Flow

visual representation

Visualize your cash-flow dynamics in order to effortlessly identify areas for financial improvement and optimize your financial plans.

Income Diversification Analysis

Analyze the diversity and stability of your income sources to ensure consistent cash flow when you need it.

Budgeting and Spending Analysis.

No matter the level of detail you prefer, FinancialAha gives you the tool to plan and make informed decisions about big financial spendings and investment opportunities.

Cash Flow financial planning

Plan a financial strategy that keeps your cash flow in balance based on forecasts and scenarios that take into consideration expenses, emergency fund, liquidity, and taxes.

Planning

for the future

Use projections empower you to plan how and when to save or make a big purchase while keeping your finances under control.

Income and expense

Set estimated monthly income and expenses for a more accurate financial projection.

Project

Understand how your net worth by adjusting the asset or debt changes percentages.

Stay on track

We recommend to make a copy of the projection in a few months to see where you are compared with the initial plan.

A Flexible and Reliable Choice

for financial planning

We used this financial planning template for several years before creating FinancialAha. This makes it an excellent choice for individuals looking for cost-effective, reliable, and adaptable tool to manage their financials.

- • pay once, use forever

- • make changes fast

- • full control of your financial data

- • proven reliability

- • familiar interface, simple to learn

- • works universally on any browser and device

- • can handle large datasets

Get acesss to FinancialAha's Planning Template for only $12.99.