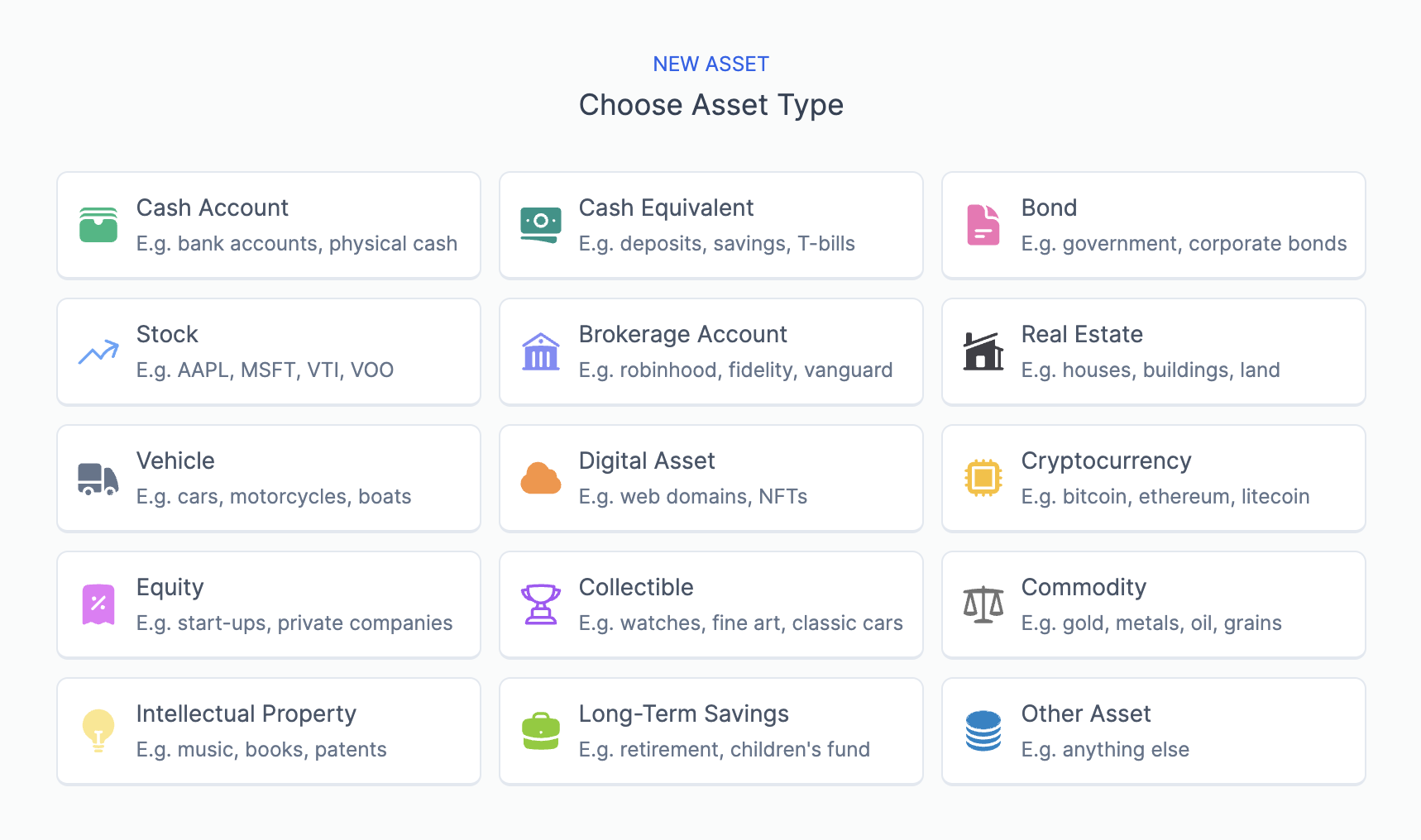

Predefined Asset Classes

FinancialAha offers multiple predefined classes of assets to help you easily structure your portfolio.

Cash Account

Cash accounts encompass physical cash on hand as well as funds held in checking accounts and other non-interest-bearing accounts. They are readily accessible for immediate use in transactions or emergencies, providing liquidity and flexibility in managing day-to-day finances.

Examples:

- Physical currency (cash on hand)

- Checking accounts

- Non-interest-bearing transactional accounts

Cash Equivalent

Cash equivalents refer to highly liquid financial instruments with short-term maturities and minimal credit risk that can be readily converted into known amounts of cash. These assets serve as temporary repositories for funds, offering stability, accessibility, and modest returns while preserving principal.

Examples:

- Certificates of deposit (CDs)

- Savings accounts

- Treasury bills (T-bills)

- Banker's acceptances

- Money market funds

Bond

Bonds are debt securities issued by governments, municipalities, corporations, or other entities to raise capital. When an individual purchases a bond, they are essentially lending money to the issuer in exchange for periodic interest payments (coupon payments) and the return of the bond's face value (principal) at maturity. Bonds serve as fixed-income investments, offering a predictable stream of income and the return of principal over a specified period.

Examples:

- Government bonds (issued by a country's government itself e.g., Treasury bonds, gilt-edged securities, bunds)

- Municipal bonds (issued by local governments)

- Corporate bonds (issued by corporations)

- Agency bonds (issued by government-sponsored enterprises)

Stock

Stocks, also known as shares, represent ownership stakes in publicly traded companies. When an individual purchases stock, they acquire a fractional ownership interest in the company, entitling them to a portion of the company's assets and earnings. Stocks offer investors the potential for capital appreciation, dividend income, and participation in the company's growth and profitability.

Examples:

- Individual stocks: Shares of publicly traded companies that represent ownership interests in specific corporations.

- Equity Funds:

- Exchange-traded funds (ETFs): Investment funds that trade on stock exchanges and typically hold a portfolio of stocks, bonds, commodities, or other assets.

- Closed-End Funds (CEFs): Investment companies that raise capital through an initial public offering (IPO) and invest in a portfolio of securities, trading on stock exchanges like individual stocks.

- Specialized Equity Instruments: Financial securities that possess unique characteristics or features beyond traditional common stock ownership, providing additional benefits or flexibility. E.g. preferred stocks, options, convertible securities, warrants, Rights offerings, american depository receipts (ADRs).

Brokerage Account

A brokerage account is a type of financial account that individuals open with a brokerage firm to buy and sell various financial securities, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), options, and other investments. Brokerage accounts serve as intermediaries between investors and financial markets, providing a platform for executing trades, managing investment portfolios, and accessing a wide range of investment products.

Brokerage accounts may incur fees and commissions for various services, including trade executions, account maintenance, investment advisory services, and access to specialized research or data.

Real Estate

Real estate encompasses physical properties, land, and structures, along with the rights and interests associated with them. Investing in real estate involves acquiring, owning, managing, and/or selling properties for various purposes, including residential, commercial, industrial, and agricultural uses.

Real estate investments can generate income through rental payments from tenants, lease agreements, or other forms of property occupancy. Real estate values have the potential to appreciate over time due to factors such as increasing demand, improvements in property condition, economic growth, and inflation.

Expenses associated with real estate investments can encompass expenses considered as investments aimed at increasing the value of the property, and those related to ongoing management and maintenance:

- Investment Expenses: These are expenses incurred with the intention of improving the property's value or income potential over the long term.

- Operating Expenses: These are ongoing expenses associated with the day-to-day operation, management, and maintenance of the property.

Examples:

- Residential Properties: Single-family homes, condominiums, townhouses, duplexes, and multi-family apartment buildings.

- Commercial Properties: Office buildings, retail centers, shopping malls, warehouses, industrial facilities, hotels, and mixed-use developments.

- Land Investments: Vacant land, agricultural land, and development sites for future construction or investment.

Vehicle

Vehicles encompasses tangible assets used primarily for transportation purposes that serve as modes of transportation for individuals and are not primarily acquired as collectibles.

Unlike certain Collectibles, such as classic cars or vintage motorcycles, most vehicles in this asset class are subject to depreciation over time due to factors such as wear and tear, age, mileage, and market demand. Owning and operating vehicles entail ongoing expenses that contribute to the total cost of vehicle ownership and impact the overall financial burden associated with owning vehicles.

Examples:

- Automobiles: Cars, SUVs, trucks, vans, and hybrid/electric vehicles.

- Motorcycles: Street bikes, cruisers, touring bikes, sport bikes, and standard motorcycles.

- Recreational Vehicles (RVs): Motorhomes, camper vans, travel trailers, fifth-wheel trailers, and pop-up campers.

- Boats: Motorboats, sailboats, yachts, personal watercraft (jet skis), and fishing boats.

- Aircraft: Single-engine airplanes, multi-engine airplanes, helicopters, and private jets.

Digital Asset

Digital assets include intangible assets that exist in digital form and hold value or represent ownership rights. These assets are stored and transacted electronically, often leveraging blockchain technology or distributed ledger systems for secure and decentralized record-keeping. Digital assets can include various types of non-cryptocurrency digital tokens, non-fungible tokens (NFTs), digital securities, digital collectibles, domain names acquired for speculative purposes or investment, and other digital representations of value which are not cryptocurrencies or Intellectual Property assets.

Examples:

- Digital Tokens: Utility tokens, security tokens, stablecoins, and other cryptographic tokens representing ownership rights, access to digital services, or participation in blockchain networks.

- Non-Fungible Tokens (NFTs): Unique digital assets representing ownership of digital art, collectibles, virtual real estate, gaming assets, intellectual property, or other digital creations, often traded on NFT marketplaces.

- Digital Securities: Tokenized versions of traditional financial securities, such as stocks, bonds, real estate, or commodities, issued and traded on blockchain-based platforms for enhanced liquidity, transparency, and efficiency.

- Digital Collectibles: Collectible items, virtual goods, or digital memorabilia represented as digital assets on blockchain networks, including digital art, trading cards, virtual avatars, and in-game items.

- Domain Names: Domain names acquired for speculative purposes or investment, without association to specific brands, trademarks, or existing businesses, and held with the expectation of capitalizing on potential appreciation in domain value or resale opportunities.

Cryptocurrency

Cryptocurrencies comprises digital or virtual currencies that utilize cryptographic techniques to secure transactions, control the creation of new units, and verify the transfer of assets. Cryptocurrencies operate on decentralized networks, typically based on blockchain technology, which enables peer-to-peer transactions without the need for intermediaries such as banks or governments.

Examples:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Tether (USDT)

- Solana (SOL)

- USD Coin (USDC)

- Dogecoin (DOGE)

- and many more

Equity

Equity assets encompasses ownership interests in privately-held companies, start-ups, and other non-publicly traded entities. Equity investments in this context involve purchasing shares or ownership stakes in private businesses, granting investors ownership rights, potential dividends, and a share of the company's profits.

Equity can be gained through multiple means such as angel investing, crowdfunding platforms, syndicate investments, employee stock options, secondary market transactions, and direct investments in private companies.

Collectible

Collectibles include tangible or intangible items that hold value or appeal to collectors due to their rarity, historical significance, artistic merit, or cultural importance. Collectibles can include a diverse range of items, such as:

Examples:

- Art: Paintings, sculptures, prints, and other works of art by renowned artists or from specific artistic movements.

- Antiques: Furniture, ceramics, glassware, silverware, and other items with historical or aesthetic value, typically over 100 years old.

- Numismatics: Rare coins, currency, medals, and tokens prized for their historical significance, rarity, or numismatic value.

- Philately: Rare stamps, postal history, and philatelic items valued for their rarity, design, historical context, and condition.

- Vintage Toys and Games: Antique or collectible toys, board games, action figures, model trains, and other childhood memorabilia.

- Sports Memorabilia: Autographed sports memorabilia, trading cards, game-worn jerseys, equipment, and collectibles associated with athletes, teams, or iconic sporting events.

- Classic Vehicles: Vintage or classic automobiles appreciated for their historical significance, design, craftsmanship, and performance.

- Fine Wine and Spirits: Rare or vintage wines, spirits, and alcoholic beverages sought after by connoisseurs and collectors for their quality, provenance, and aging potential.

- Jewelry and Watches: Fine jewelry, gemstones, luxury watches, and timepieces valued for their craftsmanship, design, and rarity.

- NFT Collectibles: Blockchain-based collectibles represented as unique tokens, including virtual trading cards, digital avatars, virtual clothing and accessories designed for avatars, digital music compositions, audio recordings, sound art, and other items traded within online games and platforms. These NFT collectibles often have limited editions, special attributes, or rarity factors that appeal to collectors.

Commodity

Commodities comprise tangible basic goods or raw materials that have intrinsic value based on their utility, scarcity, and demand. Commodities serve as essential inputs in various industries and sectors of the economy, including agriculture, energy, metals, and soft commodities.

Examples:

- Agricultural Commodities: Wheat, corn, soybeans, rice, cotton, coffee, cocoa, sugar, and livestock (cattle, hogs).

- Energy Commodities: Crude oil, natural gas, gasoline, heating oil, and coal.

- Metals Commodities: Precious metals such as gold, silver, platinum, and palladium, as well as industrial metals like copper, aluminum, zinc, nickel, and iron ore.

- Soft Commodities: Soft commodities include commodities derived from agricultural products, such as coffee, cocoa, sugar, cotton.

Intellectual Property

Intellectual Property (IP) encompasses intangible assets resulting from human creativity, innovation, and intellectual effort, which are legally protected by intellectual property laws.

Examples:

- Patents: Legal protections granted to inventors for new inventions, processes, products, or designs, giving them exclusive rights to produce, use, or sell their inventions for a specified period (e.g., utility patents, design patents).

- Trademarks: Distinctive symbols, logos, names, slogans, or designs used to identify and distinguish goods or services of one business from those of others, protected under trademark laws (e.g., brand names, logos, product packaging).

- Copyrights: Legal protections granted to authors, artists, musicians, writers, and creators for original works of authorship, including literary works, artistic creations, musical compositions, films, software code, and digital content (e.g., books, songs, movies, software).

- Software and Technology Patents: Patents granted for new software algorithms, computer-implemented inventions, technological innovations, and digital technologies, protecting the unique functionality or methods of operation.

- Trade Secrets: Confidential and proprietary information, formulas, processes, techniques, or know-how that provide competitive advantages to businesses and are protected from disclosure or unauthorized use under trade secret laws (e.g., customer lists, manufacturing processes, algorithms).

- Industrial Designs: Legal protections granted to creators for original ornamental or aesthetic designs applied to products or articles of manufacture, providing exclusive rights to use or reproduce the designs for commercial purposes (e.g., product designs, packaging).

- Biotechnological Innovations: Patents granted for new biotechnological inventions, genetic discoveries, pharmaceutical compounds, medical devices, and healthcare technologies, contributing to advancements in healthcare and life sciences industries.

Long-Term Savings

Long-Term Savings are financial assets and investment vehicles designed to accumulate wealth and achieve financial goals over an extended time horizon, typically spanning several years or decades. Long-term savings strategies aim to generate returns, preserve capital, and build financial security and independence for individuals, families, and future generations.

Examples:

- Retirement Accounts: Employer-sponsored retirement plans, such as 401(k) plans, 403(b) plans, and pension plans, as well as individual retirement accounts (IRAs), including traditional IRAs, Roth IRAs, and SEP IRAs, designed to save and invest for retirement.

- Annuities: Deferred annuities, immediate annuities, and variable annuities provide long-term income and retirement benefits, offering guaranteed payments or investment growth over time.

- Education Savings Accounts: 529 college savings plans and Coverdell Education Savings Accounts (ESAs) are some examples that allow families to save and invest for educational expenses, including tuition, fees, books, and qualified education expenses.

- Health Savings Accounts (HSAs): HSAs offer tax-advantaged savings and investment options for qualified medical expenses, providing individuals with a long-term solution for healthcare costs during retirement or later years.

- Permanent Life Insurance: Whole life insurance, universal life insurance, and other forms of permanent life insurance provide death benefit coverage and cash value accumulation, serving as long-term savings vehicles with tax-deferred growth potential.

Other Asset

Other Assets encompasses a diverse range of tangible and intangible assets that do not fit within the predefined categories mentioned above. These assets may include unique or specialized holdings, or niche investments that possess value or significance to individuals or investors. Other assets serve as a catch-all for unconventional, non-traditional, or miscellaneous assets that may not be easily classified into conventional investment categories.