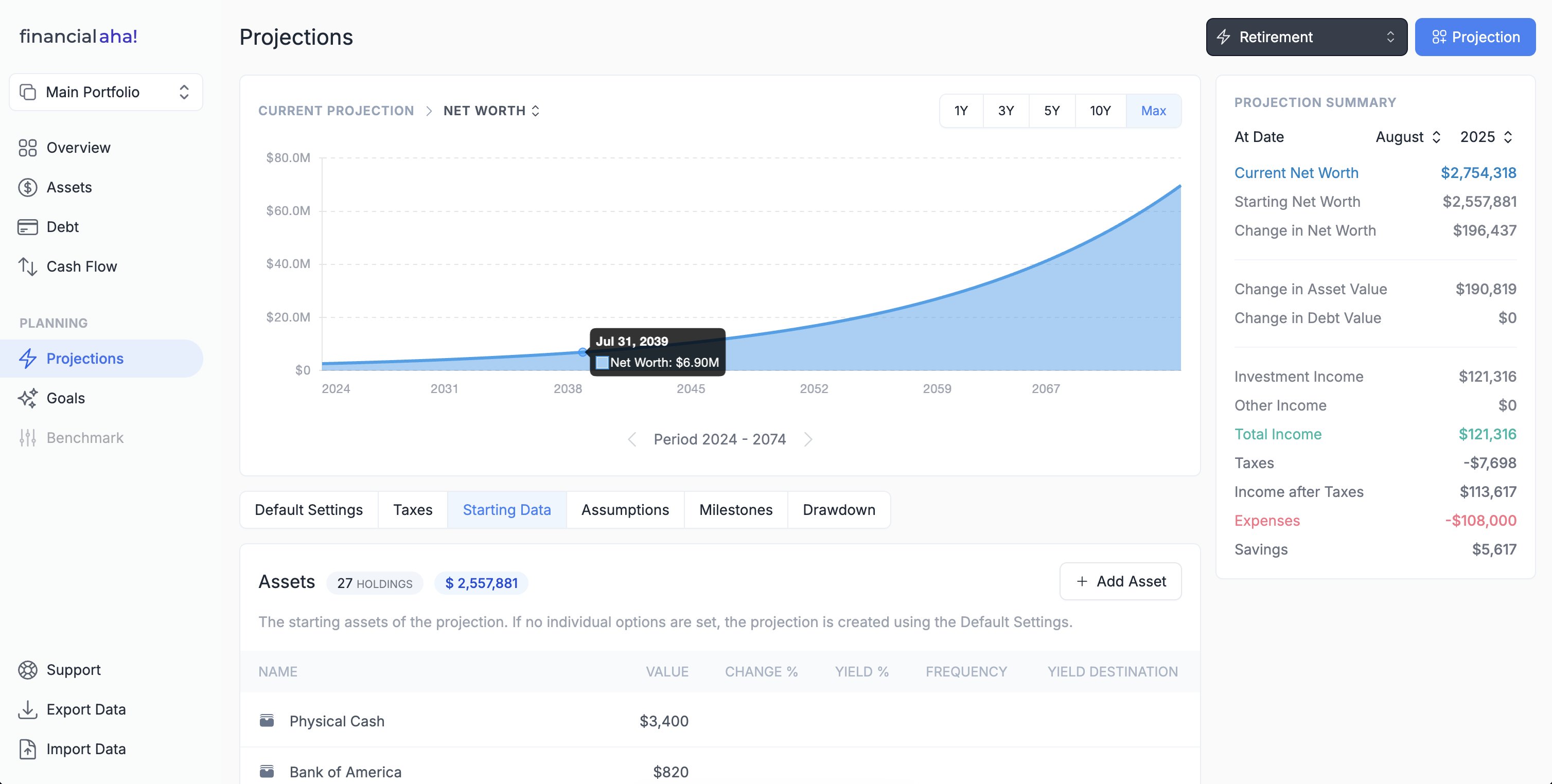

Plan Your Financial Future

Whether it's forecasting investment returns, estimating retirement savings, or planning a big purchase, having a tool that creates accurate financial planning is immensely beneficial.

Financial Planning Tools Start for free

Projections created

to be your own.

Start from your current portfolio, tweak anything and everything to ensure the projection fits your personal life.

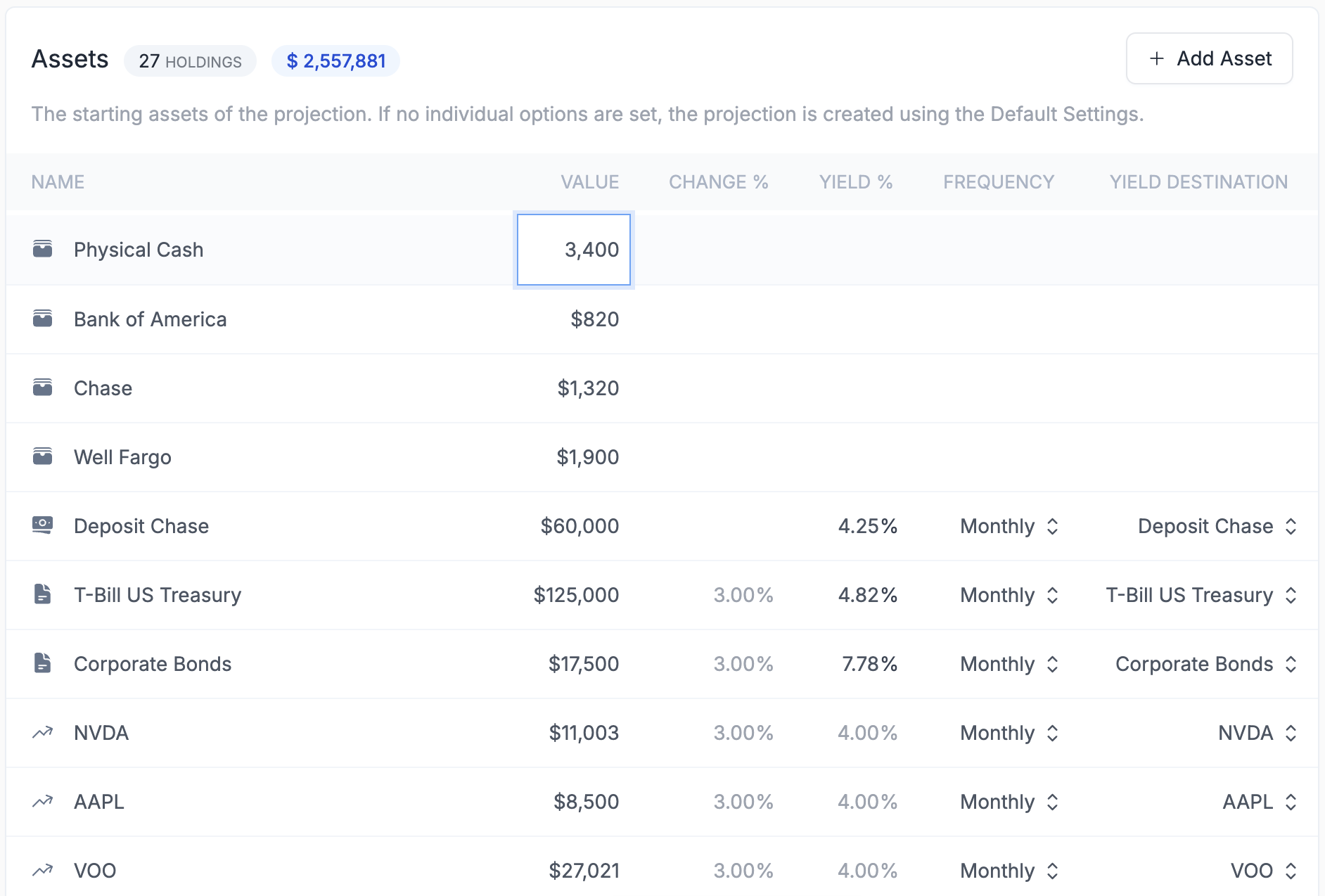

Starting Data

Start Fast. Stay Flexible.

Start. Creating a new projection is simple and fast, using your current portfolio as the starting point for any projection. This provides an accurate snapshot of your existing assets, liabilities, and investments.

Edit. You have complete control and flexibility to change the starting data of any projection. From changing values and yields to adding or removing specific assets and debts.

Milestones

Define your milestones.

Notice how close your current financial portfolio can take you to your milestone, and start planning your financials to make progress toward them.

Retirement

Financial Freedom

Homeownership

Debt reduction

Education funding

Major life event

Big Purchase

First million

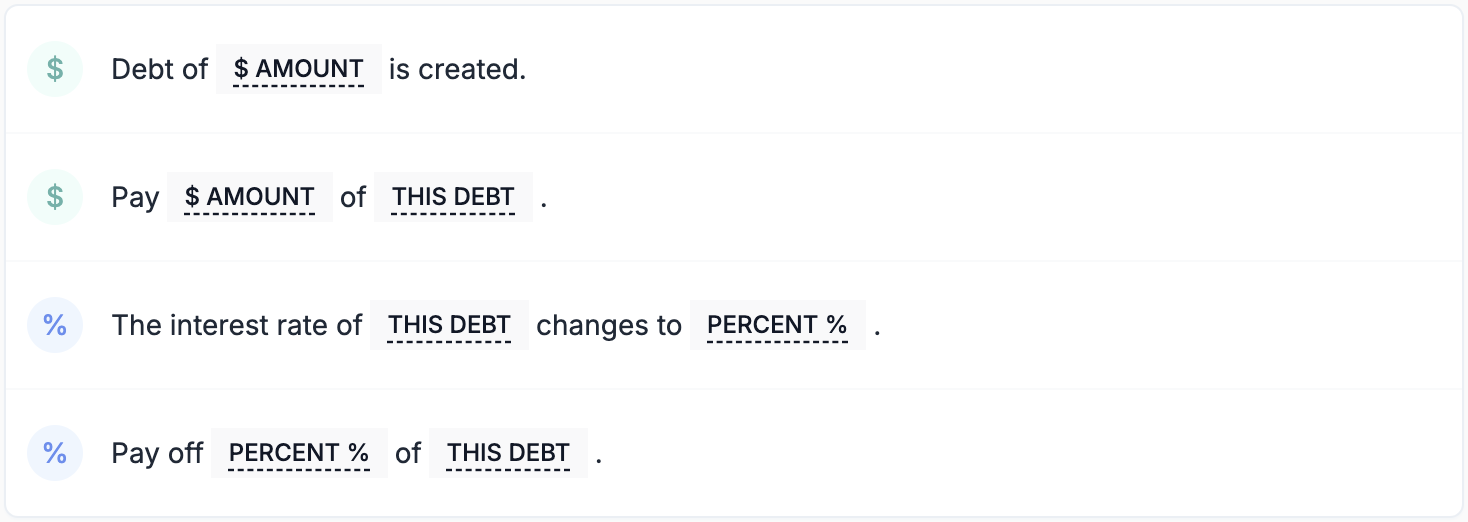

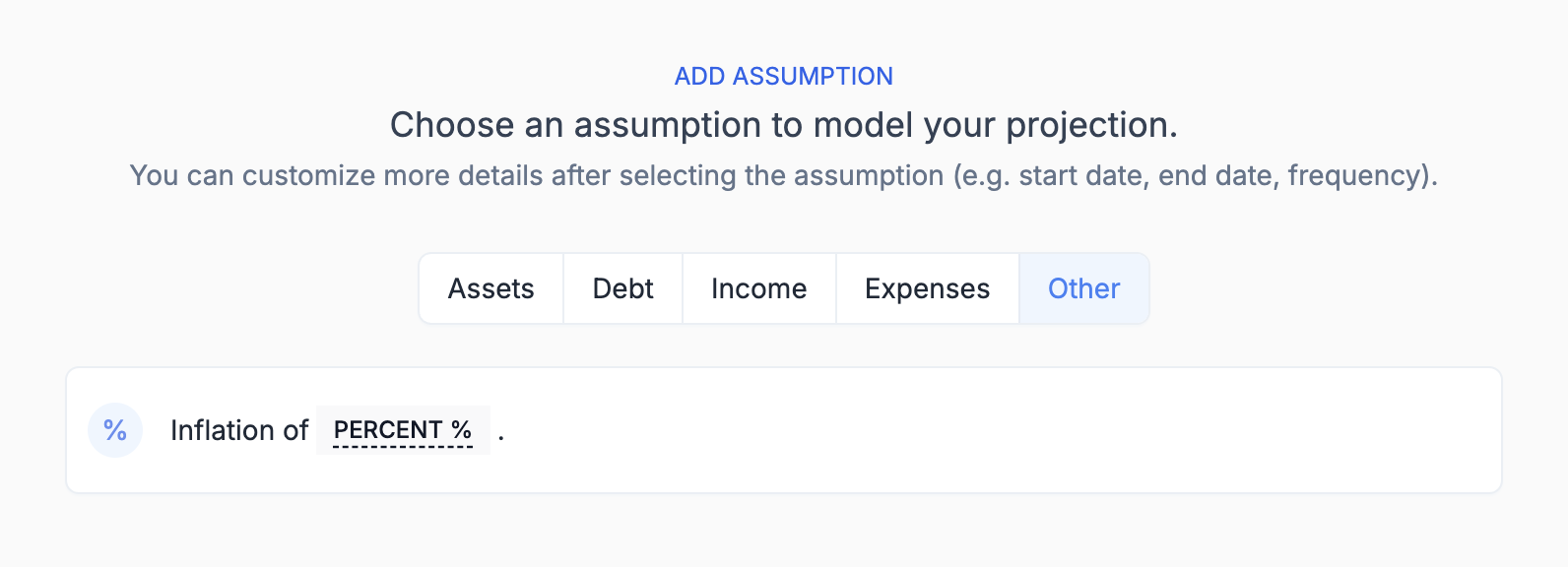

Assumptions

Fine tune your projections.

Start planning and making assumptions to help you understand how to reach your financial milestones easier.

Assumptions provide you with a way to include other factors, such as market conditions, inflation, future income or expenses, changes in asset allocation and in debt, everything at a chosen moment in time.

Assets assumptions:

- reinvest your ROI

- invest new income

- transfer funds from one asset to another

- consider market changes

- withdraw money from an asset

Debt control:

- create debt

- pay debt

- interest rate changes

- debt pay offs

Income assumptions:

- receive new income

- transfer amount or percent of income

Plan expenses:

- regular expenses

- plan big expenses

Inflation

Inflation has an important influence on personal finances, therefore it is important to not omit it from your projection's assumptions.

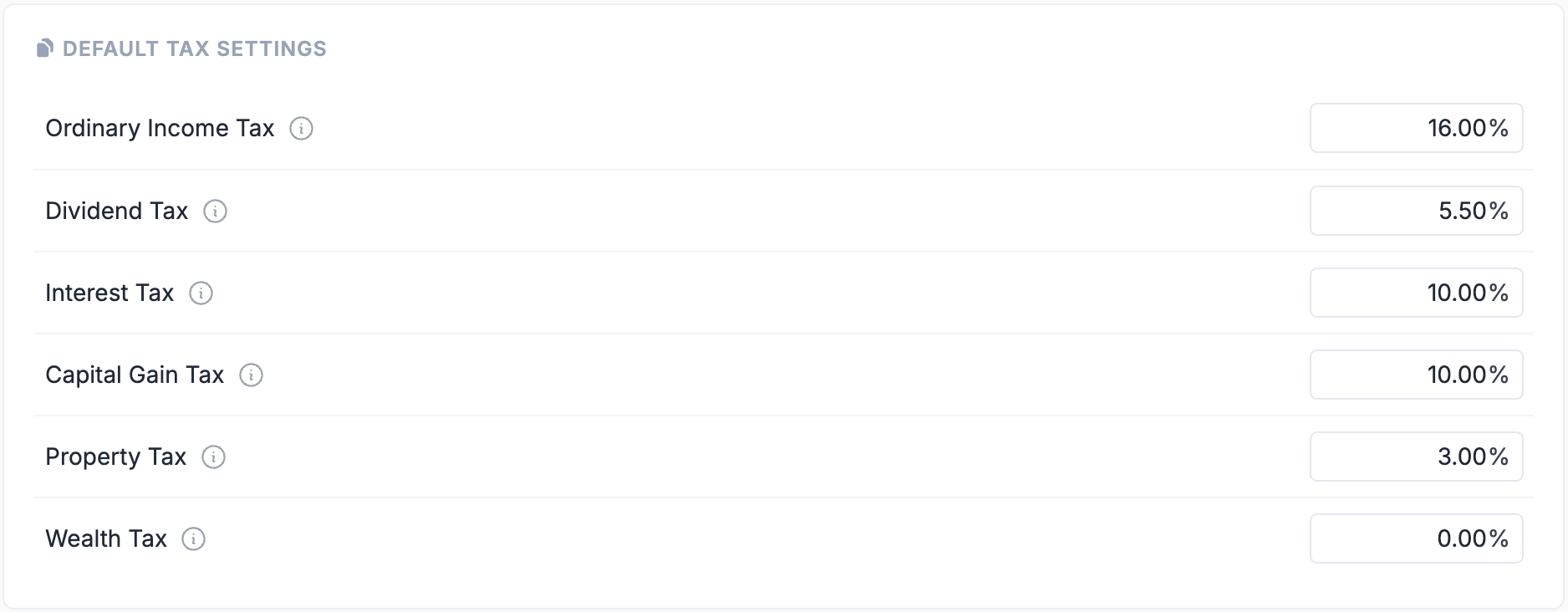

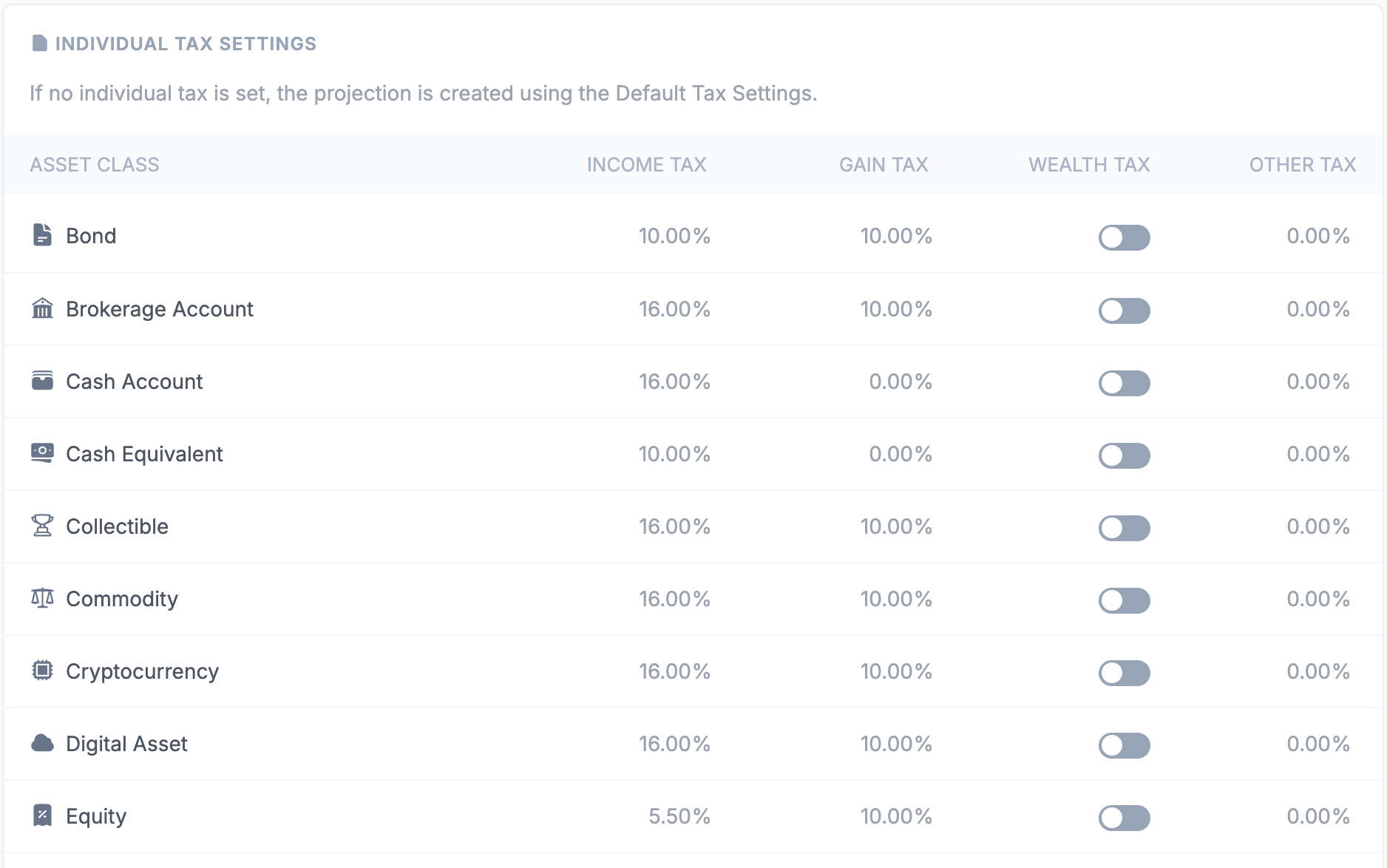

Taxes

Don't forget taxes.

Taxes can be a big part of your investment portfolio. Configure the taxes you have to pay in your jurisdiction to make your projections more accurate and realistic.

Default Taxes. These are the main types of taxes that can be encountered in most jurisdictions.

Individual Taxes. Some asset classes may be exempt from taxes or may follow a preferential taxation system in your jurisdiction. You have the option to configure your projections with individual taxes on each asset class.

Drawdown

What is your drawdown rule?

A drawdown rule dictates how much money you can withdraw from the assets in your portfolio in the first year, adjusting that amount annually for inflation in the subsequent years.

Dynamic Financial Planning

Compare and sync for a dynamic planning and better alignment with evolving financial circumstances.

Compare

Be confident that your projection is accurate and your strategy is effective. Use it to compare your current financial progress.

Sync Projection

Periodically adjustments might be needed to improve accuracy. Sync the projection with your current financial status to reflect new data and assumptions.

New Projection

Want to compare with your initial projection while still syncing your progress? Create a new projection based on the original one and your current financial data.